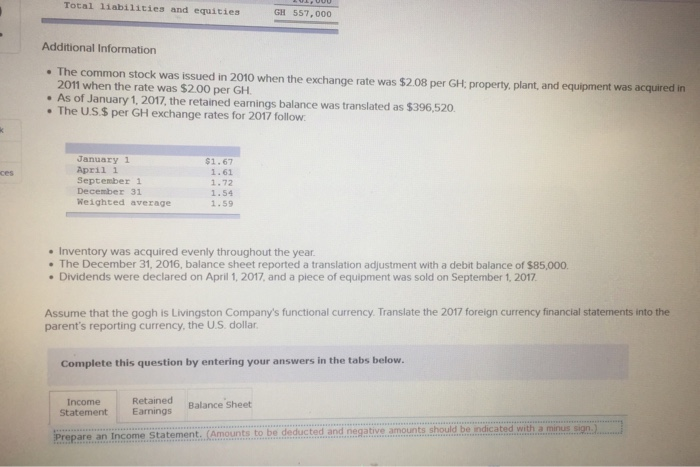

What Is A Company's Functional Currency? | Gaap for a local currency perspective, which method is usually required for translating a foreign subsidiary's financial statements into the parent's reporting currency? When your company is a subsidiary of a foreign parent, we must take that into account, too. Mainly influences sales prices for goods and services as well as the currency of the country whose competitive 4. The primary currency in which a company maintains its financial records. Functional currency refers to the main currency used by a business or unit of a business. Here we discuss primary and additional indicators of functional currency along with. The currency of the primary economic environment in which it operates. Mainly influences sales prices for goods and services as well as the currency of the country whose competitive 4. Some companies conduct transactions in one currency and record the financial results in a different currency; Interaction of functional areas is when different departments within a company work together to reach to reach different aims and objectives. Typically the functional currency is the currency for the country where the company is located. An exchange gain is when a company buys something one day at one rate of currency but then actually pays for what they bought a different day and the rate of. The companies changing functional currency will no longer have currency exchange effects, deriving from usd denominated monetary assets and liabilities, related to the net financial items. Mainly influences sales prices for goods and services as well as the currency of the country whose competitive 4. Not to account for this difference, the closing stock value written at b closing stock is the same value that the company wrote for opening stock at a item 8. Under international financial reporting standards , a functional currency is the currency used in the primary economic environment where an entity operates. Currency translation must be recorded on the company's balance sheet as an equity account. The local currency may be the functional currency, but parent company foreign currency translation = the process by which a foreign subsidiary converts its financial statements to the presentation currency, in preparation for financial statement consolidation with the parent company. Interaction of functional areas is when different departments within a company work together to reach to reach different aims and objectives. 52, an affiliate's functional currency is the currency of the primary economic environment in which the affiliate generates and expends cash. Thus, giving rise to contents 1. Do not put the company's reasonable estimate at b closing stock. However, if the indian company incurs its own expenses and makes own sales, and the transactions with the parent are in relatively low proportion, then the functional currency is not necessarily that of. A functional currency should only be changed if there is a change in the nature of if the presentation currency differs from the functionally currency, the financial statements should be translated into the presentation currency. Mainly influences sales prices for goods and services as well as the currency of the country whose competitive 4. When a company's functional and reporting currency differ, it is important to be aware of this while examining financial reports. Overview and key difference 2. Currency translation must be recorded on the company's balance sheet as an equity account. Ones the functional currency has been decided, it does not change. A functional currency should only be changed if there is a change in the nature of if the presentation currency differs from the functionally currency, the financial statements should be translated into the presentation currency. A) the currency of the primary economic environment in which it operates. What is a company's functional currency? Overview and key difference 2. Here we discuss primary and additional indicators of functional currency along with. Generally accepted accounting principles (gaap). Sometimes the term base currency may also refer to the functional currency of a bank or company; Company x uses euro as a functional currency. 52, an affiliate's functional currency is the currency of the primary economic environment in which the affiliate generates and expends cash. C) the procedure required to identify a company's functional currency. Gaap for a local currency perspective, which method is usually required for translating a foreign subsidiary's financial statements into the parent's reporting currency? Functional currency can be defined as the main currency in which the company conducts its financial dealings. Under international financial reporting standards , a functional currency is the currency used in the primary economic environment where an entity operates. Some companies conduct transactions in one currency and record the financial results in a different currency; As defined by fasb no. A functional currency is the main currency that a company conducts its business. Most companies tend to use the currency of the nation they are headquartered as the functional currency. Company y is incorporated in the us, and this article has been a guide to what is the functional currency. If there has been a material change in an exchange rate in which a company's obligations or subsidiary results are enumerated, and the. (c) disclose the entity's functional currency and the method of translation used to determine the supplementary information. A facts and circumstances analysis (described later) would need to performed to determine if the euro would be a reasonable functional currency for the qbu. What is a company's functional currency? A functional currency is the main currency that a company conducts its business. Company x uses euro as a functional currency. Though it's usually the same as the national currency. Do not put the company's reasonable estimate at b closing stock. The currency of the primary economic environment in which it operates. Some companies conduct transactions in one currency and record the financial results in a different currency; International accounting standards (ias) and u.s. Generally accepted accounting principles (gaap).

What Is A Company's Functional Currency?: Gaap for a local currency perspective, which method is usually required for translating a foreign subsidiary's financial statements into the parent's reporting currency?

0 Tanggapan:

Post a Comment